Opening: The willingness of a Wall Street investment bank to pay me hundreds of thousands of dollars to dispense investment advice to grown-ups remains a mystery to me to this day.

Review: It tells the story of how mortage-backed securities led to the global financial crisis in 2008. It exposes how rigged the system is in favour of corporations which makes me even more cynical about wall street.

You might think it’s probably dull, complicated and packed with wall-street jargons. It’s not the case with this one. Michael Lewis creates a narrative on par with those best-selling fictions. It’s still sort of technical but complex ideas like credit default swap (CDS), collateralized debt obligation (CDO) are very well explained.

I watched the movie first. It helped me to grasp the idea of those financial instruments like Anthony Bourdain uses fish stew analogy to explain CDO.

Overall, It’s a real page-turner. I loved it!!!

Highlights

“Bear Stearns has been the subject of a multitude of rumors concerning our liquidity,” it began. Liquidity. When an executive said his bank had plenty of liquidity it always meant that it didn’t.

Chapter 10 : Two Men in A Boat (Loc 3295)

It reminds me of Rohinhood restricted trading of GameStop and a bunch of other securities.

“There was no liquidity problem” Vlad Tenev told CNBC. And later he admitted it was a liquidity issue in an interview with Dave Portnoy. Did he just blatantly lie?

The line between gambling and investing is artificial and thin. […] Maybe the best definition of “investing” is “gambling” with the odds in your favor.

Epilogue : Everything is Correlated (Loc 3634)

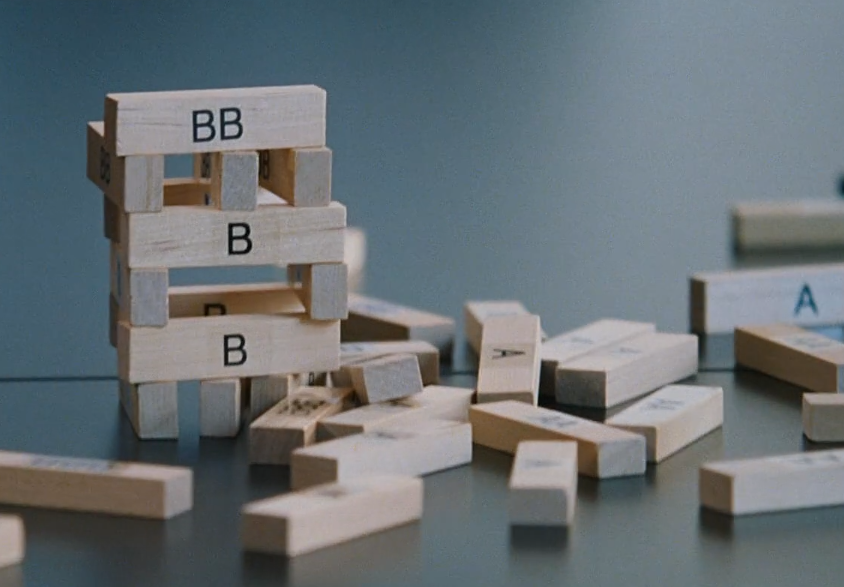

What are the odds that people will make smart decisions about money if they don’t need to make smart decisions–if they can get rich making dumb decisions? The incentives on Wall Street were all wrong; they’re still all wrong.

Epilogue : Everything is Correlated(Loc 3647)